A Bank Account Activation Form is a crucial document for individuals looking to reactivate their dormant bank accounts. It requires filling out personal details, choosing additional services if needed, and providing updated customer information. To ensure your account is updated with the latest information and services you desire, click on the button below to fill out your Bank Account Activation Form.

Download PDF

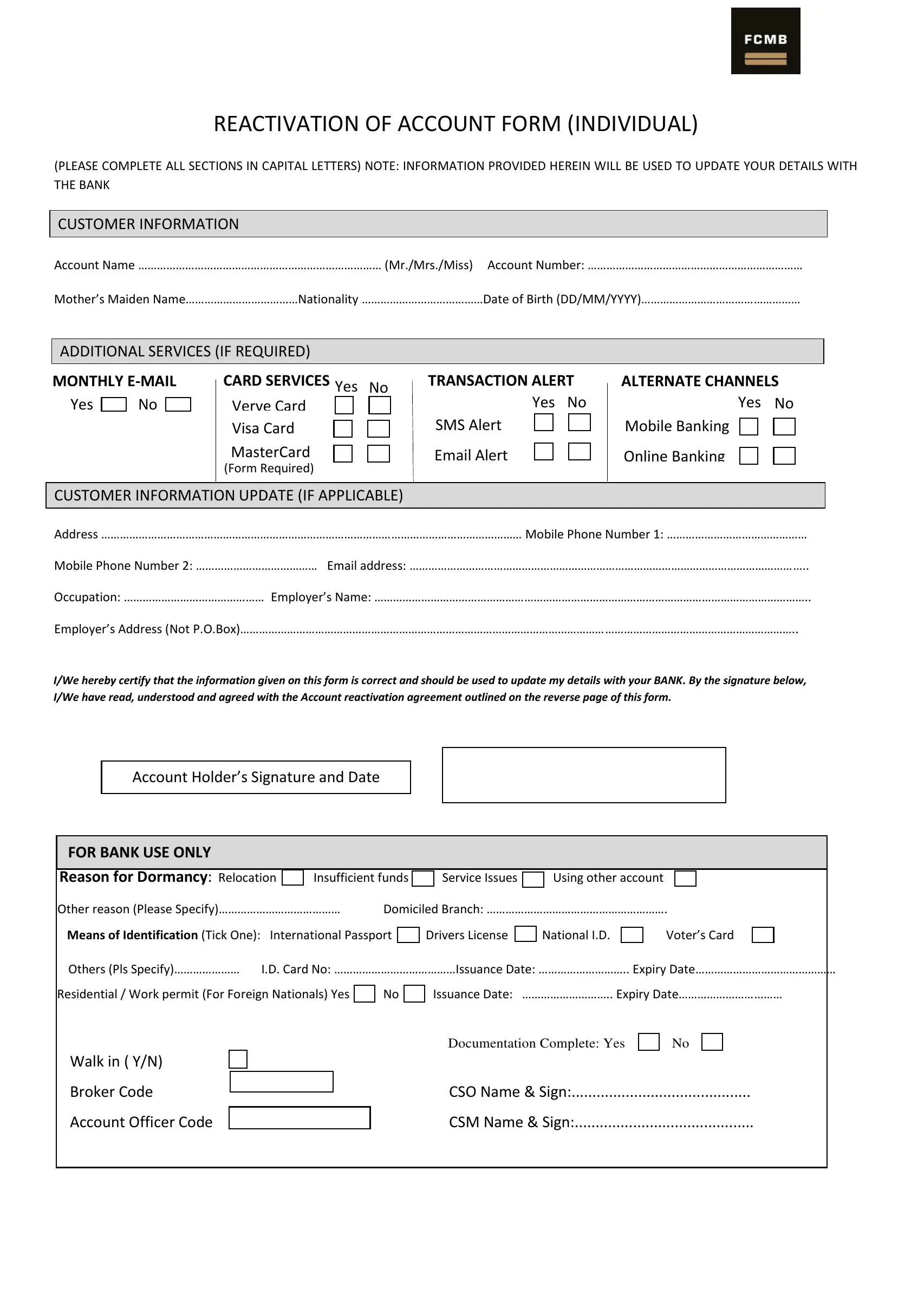

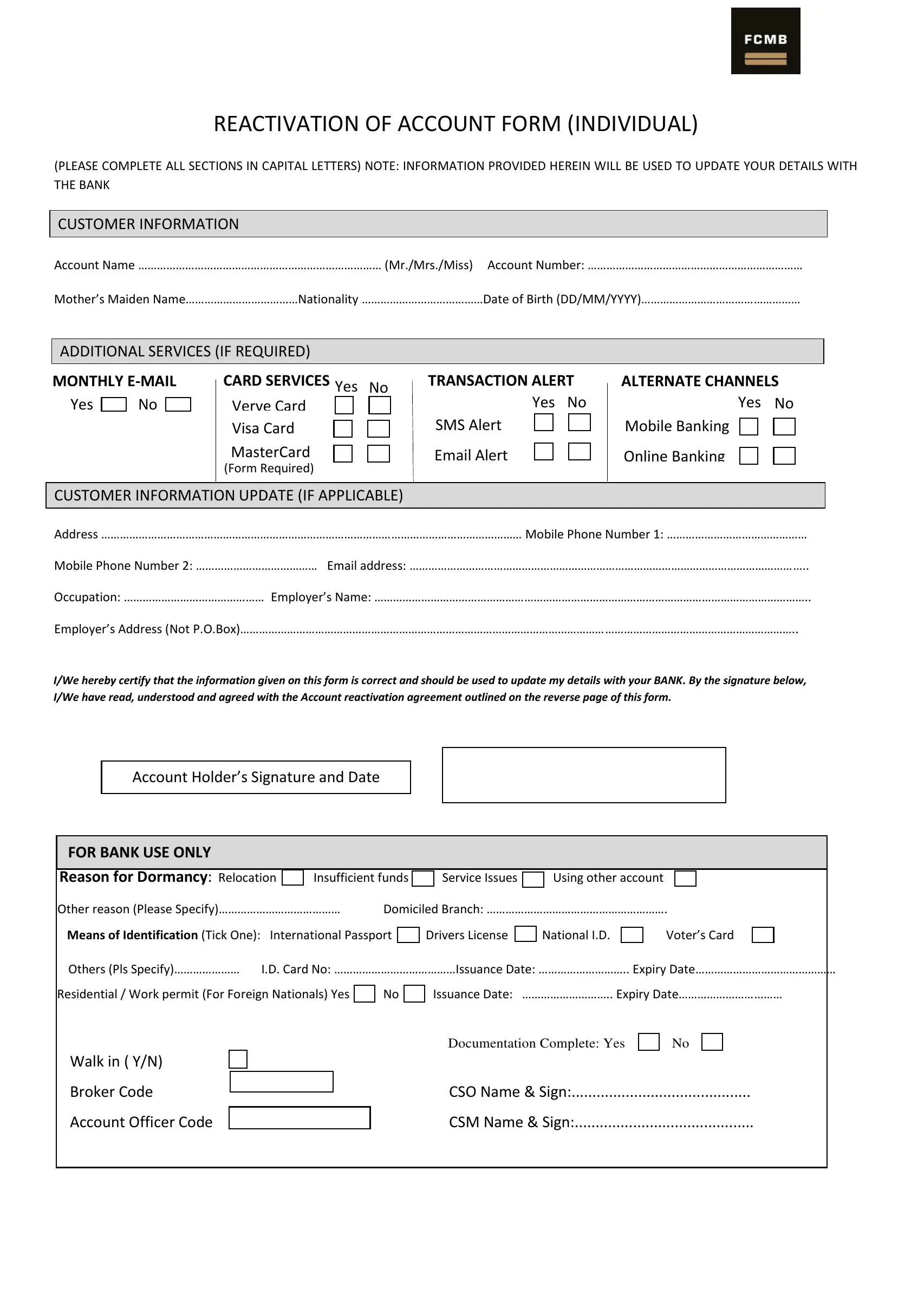

Navigating the complexities of banking processes often requires dealing with specific forms designed to safeguard both the financial institution and the account holders. Among these, the Bank Account Activation Form plays a pivotal role, especially for individuals seeking to reactivate their dormant accounts. Filled out in capital letters for clarity, this form encompasses a comprehensive suite of information, beginning with basic customer details such as account name, number, mother’s maiden name, nationality, and date of birth, extending to the decision on opting for additional services like monthly e-mail statements, card services, transaction alerts, and alternate channels including mobile and online banking. Moreover, it facilitates the updating of customer information, if necessary, signifying its dual purpose not only as a reactivation instrument but also as a tool for information refresh. The form further outlines the conditions under which the reactivated account will operate, touching on aspects such as the bank's obligations, electronic banking terms, and the client’s responsibilities towards maintaining the confidentiality of their security information. The form’s structure, requiring an intricate disclosure of personal and financial data, underscores the importance of accuracy and honesty in banking operations, while also reminding clients of their roles in safeguarding their account’s security.

| Question | Answer |

|---|---|

| Form Name | Bank Account Activation Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | how to activate my fcmb account, fcmb account reactivation code, my fcmb account update online, how to remove my fcmb account from dormant |

REACTIVATION OF ACCOUNT FORM (INDIVIDUAL)

(PLEASE COMPLETE ALL SECTIONS IN CAPITAL LETTERS) NOTE: INFORMATION PROVIDED HEREIN WILL BE USED TO UPDATE YOUR DETAILS WITH THE BANK

Mothe ’s Maide Na e………………………………Natio alit …………………………………Date of Bi th DD/MM/YYYY ……………………………………………

ADDITIONAL SERVICES (IF REQUIRED)

CARD SERVICES Yes No

CUSTOMER INFORMATION UPDATE (IF APPLICABLE)

I/We hereby certify that the information given on this form is correct and should be used to update my details with your BANK. By the signature below, I/We have read, understood and agreed with the Account reactivation agreement outlined on the reverse page of this form.

A ou t Holde ’s “ig atu e a d Date

FOR BANK USE ONLY

Reason for Dormancy : Relocation

Using other account

Othe easo Please “pe if …………………………………

Means of Identification (Tick One):

Othe s Pls “pe if ………………… I.D. C a d No: …………………………………Issua e Date: ……………………….. E pi

Reside tial / Wo k pe it Fo Fo eig

Documentation Complete: Yes

Account Officer Code

1. We confirm that my/our account(s) and all banking transaction between e/us the usto e , o I , o

e a d Fi st Cit Mo u e t Ba k Pl the Ba k shall e go e ed t he conditions specified below and/or

the terms of any specific agreement between me/us and the Bank or where not regulated by either the conditions or such agreement, by customary banking practices in Nigeria. I/We confirm that all information provided here will supersede all previous information given during account opening. The information here should therefore be used to update my/our details with you.

2. I/we/am/are aware that First city Monument Bank PLC is a member of a credit Reference Agency (CRA) and other credit Bureau Organization (CBOs) licensed by the central Bank of Nigeria (CBN) to create, organize and manage database for the exchange and sharing of information on credit status and history of individual and business. I/we/am/are also aware that this information shall be used for business purpose approved by the CBN and any relevant statue. As a member

of CRA and/or CBOs, the Ba k is u de o ligatio to dis lose to CRA o CBOs edit i fo atio a d a othe o fide tial o pe so al i fo atio dis losed to it i the ou se of a ke \customer relationship with it.

3. I/we agree that the Bank may collect, use and disclose such information to CRA or CBOs and that the credit bureau may use the information for any approved business purpose as may from time to time be prescribed by the CBN and\or any relevant statute.

4. I/we understand that information held about me/us by the CRA or CBOs may already be linked to records relating to one or more of my/our partners or associates. I/we may be treated as financially linked and our/my application will be assessed with reference to any associated records. In addition, for any joint application made by us/me with any other person(s), new financial association may be created at the CRAs or CBOs which link our financial records.

5. I/we hereby warrant that you are entitled to disclose information, both written and oral, about me/us, any or guarantor and/or anyone else referred to by me/us, and to authorize you to search and/or record such information at CRA or any CBOs, which will link my/our financial records. I/we hereby agree to indemnify and hold the bank harmless against all claims costs, fees, expenses, damages and liabilities against the Bank relating to, or arising as a result of, the disclosure of information about us/me or such or guarantor or other person or any use information by CRAs or any CBOs in compliance with the provisions of any Guideline and/or relevant statute.

6. I/ e he e elease a d dis ha ge Fi st Cit Mo u e t Ba k Pl f o its, o ligatio u de the Ba ke ’s dut of se e a d forswear my/our right to any claim, damages, loss etc on account of such disclosure to CRAs or use by the CRAs or CBOs in accordance with the provision of any CBN Guideline and /or relevant statute.

We confirm and agree that the following terms and conditions shall govern my/our Electronic Banking transaction with the Bank: